Employees and job candidates both rank a competitive employee benefits package as a leading consideration (second only to salary) when evaluating employment opportunities. And many prioritize companies that demonstrate a commitment to their physical and mental health and wellness through top-tier employee benefits offerings.

For small or mid-sized businesses, however, it can be challenging to compete with large corporations that have extensive budgets for employee benefits. The good news? The landscape has shifted, and you now have options available that allow you to offer a Fortune 500 employee benefits package without being a Fortune 500 company. One of those options is partnering with a professional employer organization (PEO). We’ll touch on that later in the article.

A competitive employee benefits package is key to attracting skilled candidates and retaining qualified workers. "When your business offers benefits, it shows that you believe in your company, that you have strong enough finances to afford benefits, and that you want to invest in your workforce," states Business.com's Top 5 Reasons to Offer Employee Benefits. “Put simply, benefits suggest you've got what it takes to be a great employer―which in turn attracts great employees."

In this article, we’ll provide you with information that can help you evaluate the pros and cons associated with offering a Fortune 500-level employee benefits package, including:

- The spectrum of benefits that comprise a Fortune 500 employee benefits package.

- What types of businesses benefit from providing employees with comprehensive benefits.

- How to partner with a professional employment organization (PEO) to build a customized Fortune 500-level benefits package.

What are Fortune 500-level benefits?

Each year, Fortune magazine publishes a list of the 500 largest companies in the U.S.—ranked by their annual revenue. Due to their size and correspondingly large budgets, these companies—and others of similar size—are able to offer a variety of generous benefits options to their employees. In most cases, these top employee benefits help cover costs of core healthcare needs and go above and beyond with offerings that enhance employees’ quality of life.

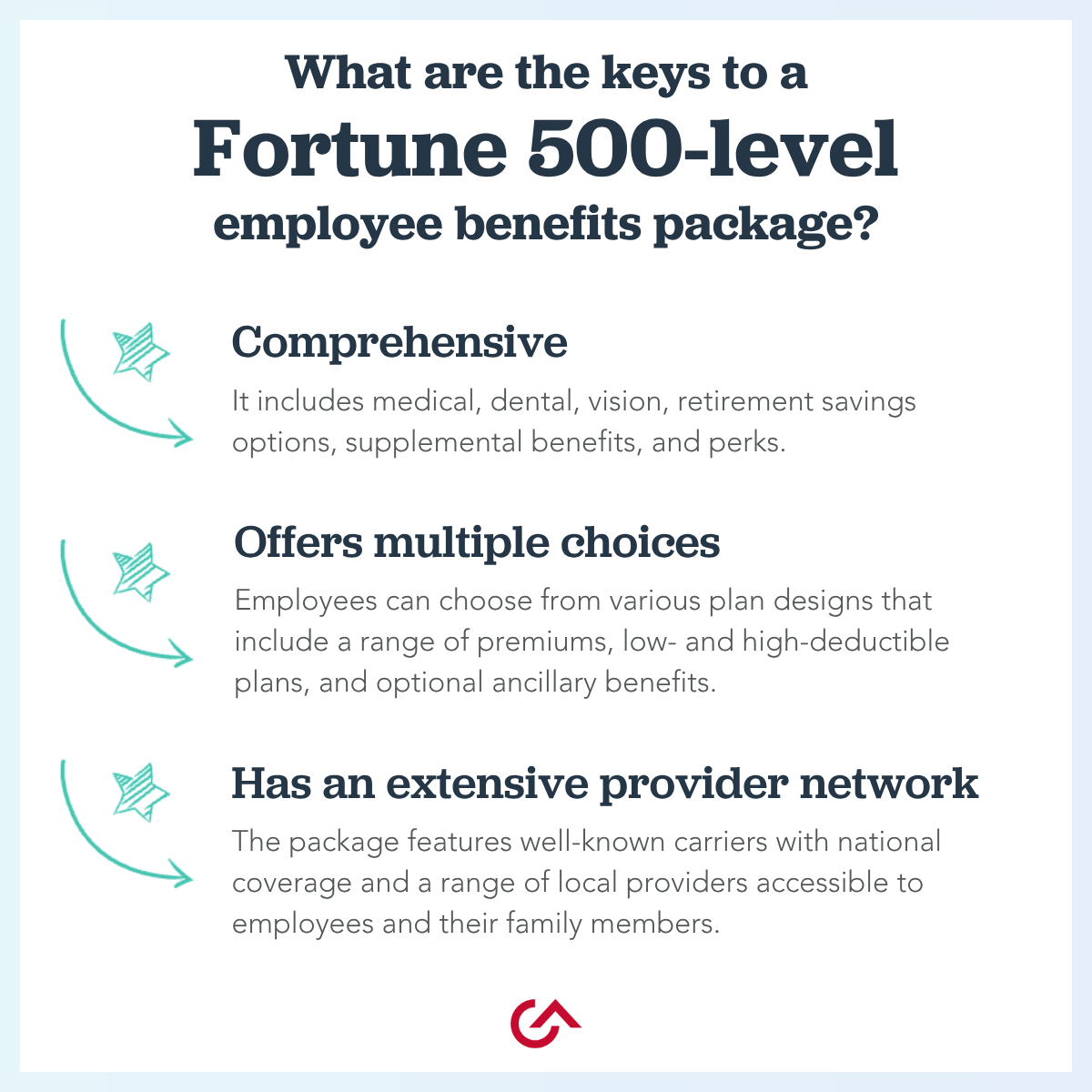

In addition, a Fortune 500-level employee benefits package:

- Is comprehensive. It includes medical, dental, vision, retirement savings options, supplemental benefits, and perks.

- Offers multiple choices. Employees can choose from various plan designs that include a range of premiums, low- and high-deductible plans, and optional ancillary benefits.

- Has an extensive provider network. The package features well-known carriers with national coverage and a range of local providers accessible to employees and their family members.

More specifically, there are four types of benefits that should be considered when building a Fortune 500-level employee benefits package:

1. Medical Benefits

Medical benefits are often considered foundational to a comprehensive employee benefits package. The Affordable Care Act (ACA) also requires employers with 50 or more full-time equivalent employees to offer health insurance to their employees or pay a penalty. Employee expectations related to health insurance plans are rising, and many are looking for:

- Top-tier group health insurance and multiple plan options, including PPOs, HMOs and HDHPs

- Prescription drug coverage

- Telehealth/telemedicine (online doctor visits)

2. Ancillary Benefits

Ancillary benefits cover healthcare services not included in traditional medical insurance plans, as well as those that provide a financial safety net for employees and their families when they need it most. These benefits include:

- Dental and vision insurance

- Voluntary disability and life insurance

- Critical illness and accident coverage

3. Retirement and Financial Planning Benefits

Adding a retirement savings option to your company’s benefits package gives you an edge when recruiting talent and retaining employees. For example, a 401(k) plan is a flexible retirement savings plan where employees participate through automatic payroll deductions (pre-tax dollars from each paycheck) invested in the plan’s offerings, typically an assortment of stock and bond mutual funds. Additional retirement and financial planning benefits options include:

- Pension plans

- Employee stock ownership plans

- Profit-sharing plans

- Financial planning assistance

4. Work/Life Benefits

Work/life benefits supplement bedrock employee benefits and appeal to workers’ shifting priorities. Many job seekers and employees value flexible workplace practices and benefits that support mental health and wellness, so a more comprehensive array of benefits helps to magnify employee satisfaction rates.

Supplemental benefits to consider include:

- Employee Assistance Programs (EAPs), which provide counseling services and support employees’ mental health and well-being

- Remote work and flexible scheduling alternatives

- Tuition reimbursement programs

- Health Savings Accounts and Flexible Savings Accounts

- Subsidized childcare options

- Wellness programs with onsite exercise classes or employee-driven challenges

- Free healthy snacks in the employee break room

- Financial wellness classes

- Time-off and leave benefits, which include vacation, sick, paid holidays, parental, and extended leave.

How to Offer Fortune 500-Level Benefits Through a PEO

Business owners concerned about the potential sticker shock associated with a comprehensive benefits package have affordable options. A professional employer organization (PEO) can negotiate on behalf of thousands of employees from multiple companies, so it has the negotiating power a small business might not have.

By partnering with a PEO, like G&A Partners, you can access top-tier employee benefits offerings, such as:

- Fortune 500-level bedrock benefits. Your business gains access to top-rated employee benefits due to the collective buying power of your PEO partner. This allows you to provide employees with high-quality medical, dental, and vision coverage and ancillary benefits at affordable rates.

- Manageable retirement plans. For many business owners, the cost of setting up and administering a retirement plan can be overwhelming. A pooled- and multi-employer 401(k) plan offered through a PEO can put your business in a position to offer employees access to a competitive 401(k) retirement plan, relieving you of this administrative burden.

- Affordable voluntary benefits. By partnering with G&A, you can access comprehensive insurance plans such as life, voluntary disability, and accident and critical illness at competitive rates and offer them to employees voluntarily with contributions covered by the employee, your business, or a combination of both.

- Quality-of-life benefits. Providing mental health and wellness-related benefits demonstrates your commitment to your workforce outside the office. When you partner with a PEO like G&A, your employees can access an Employee Assistance Program (EAP), which provides free and confidential assessments, short-term counseling, referrals, and follow-up services to employees with personal or work-related concerns.

- Paid Time Off (PTO) guidance. Wading through the maze and moving parts of federal, state, and local paid family medical and sick leave laws can be daunting for business owners. The compliance experts at a PEO can inform you of the requirements of each jurisdiction in which your company operates and ensure that you comply with paid leave regulations – providing you with the support and guidance you need.

How G&A Can Help

By combining the buying power of tens of thousands of employees across G&A's numerous client companies, we can negotiate better health insurance and benefits plans—with affordable deductibles and more comprehensive coverage—at competitive rates. Schedule a consultation with one of our trusted business advisors to learn more.