In search of equal pay and opportunities—and improved work-life balance—more employees who believe they are not being heard or treated fairly in the workplace are exploring their legal rights related to labor law compliance. As a result, worker-driven claims of unfair, unsafe, or discriminatory employment practices are on the rise in the U.S. In fact, “discrimination cases increased substantially in 2024, with the EEOC receiving over 500,000 calls and 81,055 new charges,” according to WH Law in their article, “Statistics for Workplace Discrimination in 2024.”

If left unresolved, these claims can lead to costly employment-related lawsuits for business owners. WH Law also states in their article that “the average settlement for employment discrimination complaints is approximately $40,000, potentially escalating to $300,000 depending on the employer’s size.”

“With increased protections of employee rights under both state and federal laws—not to mention state and federal legislation to limit the enforceability of arbitration agreements—employers across the country should be prepared for more lawsuits over the next few years,” says Kristen Nesbit, a Fisher Phillips partner.

What is labor law compliance?

What is labor law compliance and how can it affect your business? Labor law compliance is a set of rules and regulations that ensure your business follows federal, state and local laws that govern wages, working hours, employee benefits, safety, and discrimination. Put more simply, they are laws designed to protect workers and create a fair workplace.

For businesses, staying compliant is important for a variety of reasons. Not following labor laws can lead to big fines, legal trouble, and even hurt your company’s reputation. But when you value and abide by the rules, it builds trust with your employees, boosts morale, and overall keeps things running more smoothly. Plus, it ensures you're offering your employees (your most valuable asset) fair pay, a safe work environment, and protection from discrimination or harassment—benefits that help both your team and your business in the long run.

What are the types of labor agencies?

Labor agencies at the federal, state and local levels play a critical role in ensuring HR labor law compliance. Understanding these agencies and their responsibilities can help your organization remain compliant with the law and avoid penalties and legal risks.

Here is a breakdown of the main types:

Federal Labor Agencies

- Department of Labor (DOL): The DOL is the primary federal agency responsible for enforcing laws on wages, hours, workplace safety, and benefits like unemployment insurance.

- Equal Employment Opportunity Commission (EEOC): The EEOC handles claims related to workplace discrimination, harassment, and retaliation.

- Occupational Safety and Health Administration (OSHA): OSHA ensures workplace safety by setting and enforcing standards for working conditions.

- National Labor Relations Board (NLRB): The NLRB protects employees' rights to organize, unionize, and bargain collectively, and prevents unfair labor practices by employers or unions.

State Labor Agencies

- Every state has its own labor department that enforces both federal and state-specific labor laws. These agencies often cover wage standards, workers' compensation, and unemployment benefits.

- For example, California's Department of Industrial Relations (DIR) and the Texas Workforce Commission (TWC) are state labor agencies that handle issues like minimum wage, overtime, and worker safety.

Local Labor Agencies

- In some cities and counties, local labor offices or commissions focus on labor standards that might exceed state and federal requirements, such as higher minimum wage laws or additional paid sick leave regulations.

How do labor agencies impact HR?

The challenges experienced during the COVID-19 pandemic, coupled with ongoing social justice movements, brought long-simmering labor concerns (that had been years in the making) to the surface. As a result, employees raised their expectations of employers – actively lobbying for changes related to labor law and compliance, including:

- Workplace equality

- Flexible work schedules

- Wage and benefits improvements

- Improved work-life balance

Employees are increasingly turning to U.S. labor agencies, such as the Equal Opportunity Commission (EEOC), Occupational Safety and Health Administration (OSHA), and Wage and Hour Division (WHD), to make claims and allegations of unfair employment practices. Employees can seek advice or submit claims to these federal agencies, which have been granted authority to set and enforce established standards.

Health and safety concerns during the early days of the pandemic temporarily disrupted agency operations. But as restrictions eased, federal agencies have returned to their normal operations, and they have ramped up caseloads and investigations.

In fact, according to the U.S. Equal Employment Opportunity Commission’s 2023 Annual Performance Report, “The EEOC received 81,055 new charges of discrimination in fiscal year 2023, a more than 10% increase over the number of charges filed in fiscal year 2022.”

EEOC Plan to Address Systemic Discrimination

In fiscal year 2023, the U.S. Equal Employment Opportunity Commission (EEOC) implemented initiatives to enhance enforcement against systemic discrimination, which directly impacts HR.

These initiatives include:

- Broadening Enforcement Focus

The EEOC prioritized systemic discrimination by training staff to identify and investigate these cases.

HR Impact: HR must adapt policies and training to recognize and address systemic issues within their organizations. - Integrating Technology and Analytics

The agency leveraged technology to improve public access to information about employment discrimination laws.

HR Impact: HR should adopt similar technologies to better inform employees about their rights and available resources. - Enhancing Monitoring and Reporting

The EEOC improved monitoring of conciliation agreements and streamlined reporting procedures for systemic discrimination.

HR Impact: HR teams need to enhance their monitoring systems to ensure compliance and respond effectively to discrimination concerns.

These initiatives reflect the EEOC's proactive approach, requiring HR to adapt and promote equal employment opportunities within their organizations.

To keep in compliance with anti-discrimination laws enforced by the EEOC, business owners should consider these best practices:

- Become familiar with EEOC laws and regulations.

- Post required notices and report workforce data: Employers must post information about federal laws prohibiting job discrimination. The "Know Your Rights: Workplace Discrimination is Illegal" poster summarizes these laws and explains how an employee or applicant can file a complaint. (Learn more about the poster and download it here.) Note: Posters should be kept current, so remember to replace them when updated posters are made available.

- Audit workplace procedures: Review your hiring, onboarding, and workplace practices to make sure you comply with EEO regulations and to make sure you are ADA-compliant.

- Create an anti-discrimination policy: Develop a robust anti-discrimination policy that details employees' rights and responsibilities at work, and outline the steps your company takes to prevent harassment or discrimination.

- Instill diversity in your recruiting and retention programs: Encourage your organization's recruiters to seek candidates with diverse backgrounds and skills and monitor the hiring process to ensure there is not even the appearance of discrimination. In addition, develop a robust retention program that offers all employees equal opportunities for advancement throughout your company's talent pipeline.

- Artificial Intelligence (AI): Although there are no current federal laws regarding using AI in the hiring process, there are state laws. If there are biases within the AI system that you are using and a claim is filed, you are still responsible.

OSHA Focused on Strengthening Workplace Safety Inspections

In 2023, OSHA significantly ramped up its efforts to enhance workplace safety across high-risk industries, including construction, manufacturing, and healthcare. With an emphasis on reducing workplace injuries and fatalities, OSHA conducted 31,820 inspections in fiscal year 2022 and continued the momentum into 2023, with 34,221 inspections. The agency is prioritizing inspections related to fall protection, hazardous materials handling, electrical safety, and respiratory protection.

As part of its ongoing strategy, OSHA is concentrating on ensuring compliance with its core safety standards and addressing emerging risks in high-hazard sectors. The agency is also stepping up efforts to protect workers from long-standing safety concerns and advocating for stricter enforcement to safeguard employee well-being.

Recommendations that can help keep your employees safe and your company in compliance with the Occupational Safety and Health (OSH) Act include:

- Review current regulations to ensure you are implementing OSHA's required safety and reporting measures to provide a safe workplace that is free of known hazards.

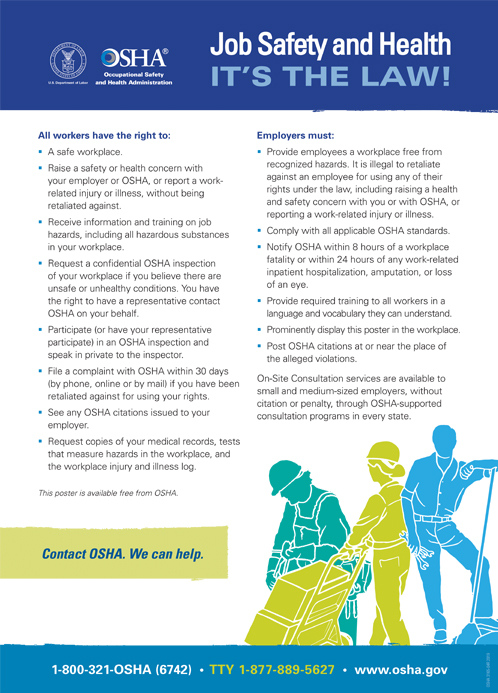

- Prominently display OSHA's “Job Safety and Health: It's the Law” poster in the workplace. Note: Posters should be kept current, so remember to replace them when updated posters are made available.

- Maintain an annual log of recordable workplace injuries and illnesses on OSHA Form 300 and retain the record for five years. This requirement applies to most employers with more than 10 employees not on the excepted industry list.

- Report all work-related fatalities within eight hours and severe injuries within 24 hours.

- Post OSHA citations at or near the site of alleged violations.

- Provide required training to all workers in a language and vocabulary they can understand.

The Wage and Hour Division’s Anti-Retaliation Initiative

Moving forward, one of the top enforcement priorities for the Department of Labor’s Wage and Hour Division (WHD) is to protect workers from retaliation for exercising their rights in the workplace. The department will also continue to combat wage theft, worker misclassification, and failure to provide leave under the Family Medical Leave Act (FMLA). According to the WHD’s Protecting Workers from Retaliation Field Assistance Bulletin, retaliation (reduced or denied pay, demotion, etc.) occurs when an employer (manager, supervisor, administrator, etc.) takes adverse action against an employee because they engaged in a protected activity, such as making a complaint to a manager or cooperating with a WHD investigation.

In addition to avoiding retaliatory actions, experts recommend that business owners shore up compliance under the Fair Labor Standards Act (FLSA), which sets minimum wage and overtime pay standards, outlines employee record-keeping requirements, and establishes child labor regulations. Note that in 2024, the DOL established an overtime rule, which would have raised the salary threshold for white-collar exemptions in July of 2024, but that ruling was challenged and ultimately struck down. Changes can happen at any time, so it’s important to stay updated on any changes so you can properly adjust employees’ salaries or reclassify employees with each update.

An increasing number of district attorneys and state attorneys general have been prosecuting employers for wage theft, and many have created dedicated units to proactively investigate wage theft and handle individual cases as they arise. Also, several states have increased the penalties on employers found guilty of wage theft. For example, in Washington, D.C., employers who commit wage theft can be found guilty of a misdemeanor and sentenced to up to 90 days in prison, in addition to a $10,000 fine for each affected employee.

Examples of wage theft include:

- Paying workers less than the legal minimum wage. This can be particularly complicated as states, cities, and counties can have different minimum wage requirements. In general, employers should follow whichever is more beneficial to the employee.

- Failing to pay non-exempt employees time-and-a-half for hours worked more than 40 hours per week.

- Asking employees to work “off the clock” before or after their shifts.

- Denying workers their legal meal breaks.

- Taking illegal deductions from wages.

- Confiscating tips or failing to pay tipped workers the difference between their tips and the legal minimum wage.

- Misclassifying employees as independent contractors to pay a wage lower than the legal minimum or to avoid paying overtime.

How G&A Can Help

G&A Partners offers expert guidance to navigate the complexities of labor regulations. Schedule a consultation today to find out how our experts can help you safeguard your business and foster a fair workplace for your employees.